How Not To Invest

Introduction: Mastering the Art of Losing Money

So, you’re ready to invest? Congratulations! That’s the first step toward building wealth… unless, of course, you’re determined to do it the wrong way. If your goal is to lose money fast, stress yourself out, and make your future self weep in regret — you’re in luck. This guide will walk you through exactly how not to invest.

Whether it’s betting your entire paycheck on meme stocks, putting your faith in your cousin’s NFT startup, or ignoring boring (but stable) options like Certificates of Deposit, we’re here to help you do it all wrong.

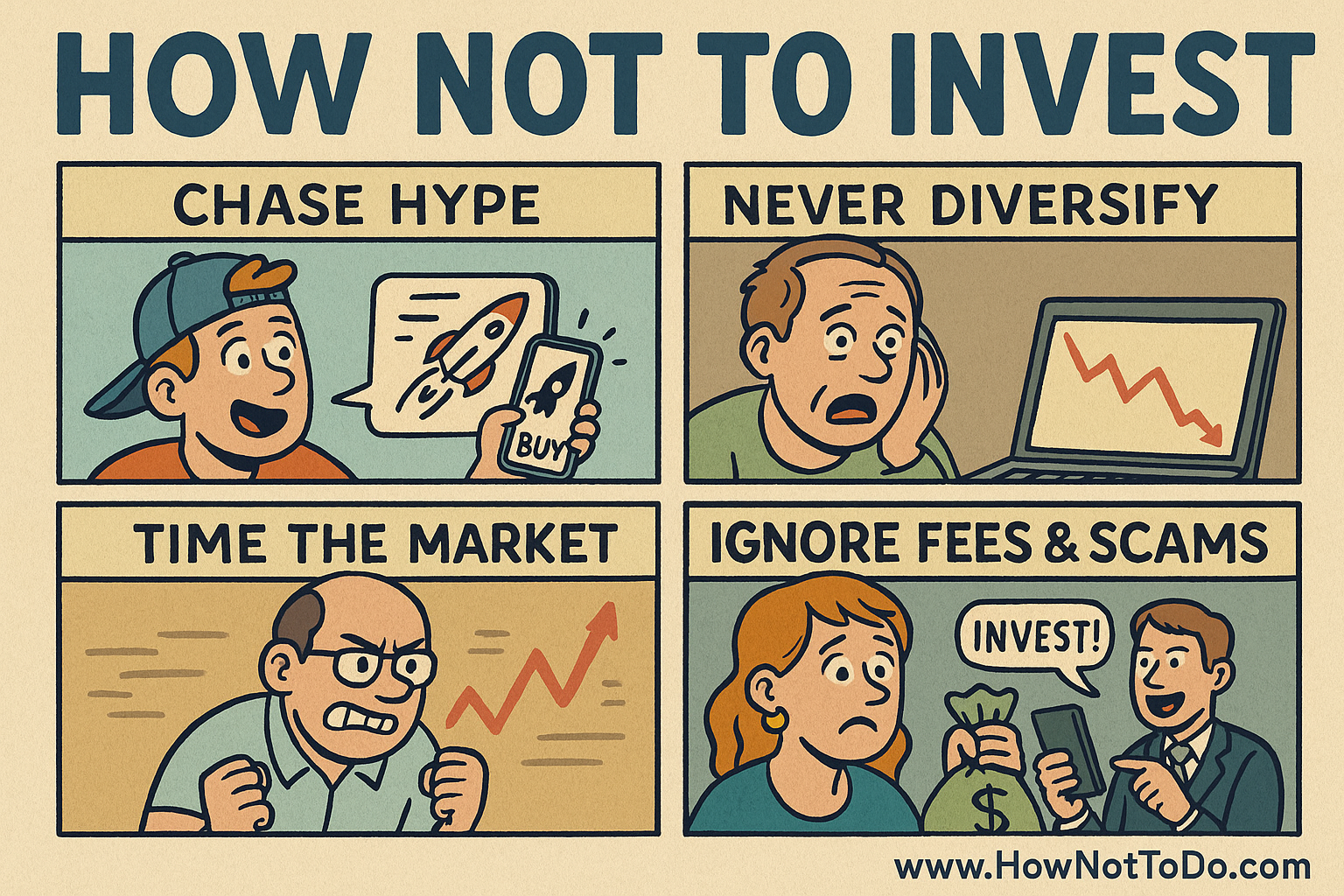

🎬 Step 1: Chase Hype, Not Value

Heard a coin called “BananaCoin” just went up 10,000%? Perfect. Throw your savings in! Read online that “AI will replace Wall Street”? Then obviously, you should buy shares in every company with “AI” in its name. Never mind fundamentals. If it’s trending on TikTok, it’s time to invest.

✅ Tip: Bonus points if your investment strategy changes hourly based on Reddit threads.

💸 Step 2: Never Diversify

The pros say “don’t put all your eggs in one basket.” But you? You’re a rebel. All-in on a single stock. Or better yet, only invest in crypto! Bitcoin to the moon, right? Forget about ETFs, bonds, or gasp boring index funds. That stuff is for people who like sleeping well at night.

✅ Remember: True financial chaos only comes from betting everything on one wild idea.

🚀 Step 3: Time the Market… Poorly

Buy high, sell low — that’s the motto! The key is to panic when the market dips, and FOMO-buy when it spikes. Never dollar-cost average. Just go all-in at the exact wrong time, every time.

✅ Want to make it worse? Check your portfolio every 10 minutes and stress-eat chips while you do.

🤑 Step 4: Ignore Fees and Scams

Why use a trusted brokerage when some guy in your DMs says he can double your money overnight? Ignore regulation, fine print, and warning signs. Whether it’s crypto rug-pulls or a “too-good-to-be-true” investment club, go all in.

✅ Pro move: Never Google the name of the “advisor” you just sent $2,000 in Bitcoin.

💎 Step 5: Treat Bitcoin Like a Lottery Ticket

Cryptocurrencies are fascinating. They’re also volatile, unpredictable, and deeply misunderstood. But who cares? If it worked for that guy who bought a Lambo in 2017, it will work for you too, right?

📉 Pro tip: Sell in a panic during every dip. Buy back during the peak. That’s how the real pros do it.

✅ Actually Want to Understand Crypto? Don’t just follow Twitter threads. Learn the tech, risk, and economics behind it. Otherwise, you’re just flipping magic beans.

🏠 Step 5.5: Buy Real Estate Blindly

Everyone’s flipping houses on Instagram — why shouldn’t you? Just find a “hot” market, overleverage with a loan you don’t understand, and forget to budget for repairs, taxes, or tenants who ghost on rent.

Real estate can be a solid investment, but treating it like a fast-track to millionaire status is how you end up with three mortgages, two headaches, and one very angry plumber.

✅ Shortcut to disaster: Skip inspections and buy the first “fixer-upper” you see because it “has good vibes.”

📈 Step 5.6: Treat Stocks Like Slot Machines

Heard your friend made 200% on a stock last year? Jump in with both feet! Forget about what the company does, earnings reports, or economic cycles. Buy high, panic sell low, and repeat.

The stock market rewards the patient — which is exactly why you should sprint into it like a caffeinated squirrel. Bonus fail: Refresh your trading app every 3 minutes and act on every impulse.

✅ Secret weapon: Financial “influencers” on TikTok promising you’ll 10x your money next week.

📉 Step 6: Avoid Research Like the Plague

Books? Nah. Financial podcasts? Boring. Why read a 3-minute article when you can take advice from your barista’s cousin who “trades options on the side”? Financial literacy is overrated.

✅ The less you know, the easier it is to be confident in terrible decisions.

🪙 Bonus Level: Slow & Steady

If you’re tired of chasing magic beans, you might want to consider options that prioritize stability over hype. For example, fixed-income products like certificates of deposit (CDs) aren’t flashy — but they’re predictable, insured, and can be a smart part of a balanced strategy. Sometimes, the boring stuff is what actually works.

🧠 Final Thoughts: Want to Win? Stop Playing to Lose

The real secret to smart investing? Avoid everything we just talked about.

- Learn first, act second.

- Think long-term.

- Diversify.

- Ignore noise.

- Accept that boring is often profitable.

It’s not about getting rich fast. It’s about getting rich eventually — without losing your mind.

👣 What To Do Instead

Here’s how to actually get on the right track:

- 📚 Read or listen to credible financial education.

- 📊 Start with index funds or diversified ETFs.

- 🧘 Stay calm during market dips.

- 📆 Invest regularly — not impulsively.

- 🛡️ Don’t fall for scams promising fast returns.

🚧 Wait… Did You Already Make One of These Mistakes?

Don’t worry. Most of us have. The important thing is you’re learning what not to do. That puts you ahead of millions of people out there still gambling their financial futures away.